Human Rights and the EU Corporate Sustainability Due Diligence Directive – the Next Hot Topic in ESG

Posted 24/06/2024

Human rights have long been a key consideration for lenders such as the IFC, EBRD, and IDB during their financing processes. The Equator Principles, one of the primary frameworks for managing sustainability and ESG risks in project finance, were updated in 2020 to mandate a Human Rights Risk Assessment for projects in all countries. Now, following the official approval by the European Commission of the Corporate Sustainability Due Diligence Directive (CSDDD), we expect that human rights will become the next hot topic in ESG.

The CSDDD mandates that large companies operating within the EU must carry out thorough assessments to eliminate potential adverse human rights and environmental impacts not only within their own operations but also throughout their supply chains. It is based on internationally recognised human rights due diligence standards, specifically the UN Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises.

We are well placed to support companies, investors and lenders in managing their obligations and risks under the CSDDD. As a global team of advisors, we have vast experience in human rights issues such as workforce protection, security management and management of vulnerable groups, and we provide a range of ESG and human rights advisory services. Below, we have set out key details of how the CSDDD will impact businesses in the EU and beyond over the coming years, alongside our perspectives.

Applicability

The CSDDD applies to large companies operating within the EU, including non-EU companies with significant business activities in the region. Specifically, it targets large EU limited liability companies and partnerships with more than 1000 employees and a net turnover exceeding €450 million worldwide. Additionally, large non-EU companies with net turnover exceeding €450 million in EU are subject to the Directive.

The CSDDD will also apply to EU or non-EU companies involved in franchising or licensing agreements within the EU if the company’s worldwide turnover exceeds 80 million euros and at least 22.5 million euros of this turnover is generated from royalties.

There are also broad implications for investors and lenders. While some may fall directly under the remit of the CSDDD themselves, many more will need to consider its implications when investing in or providing finance to affected companies.

Due Diligence Process

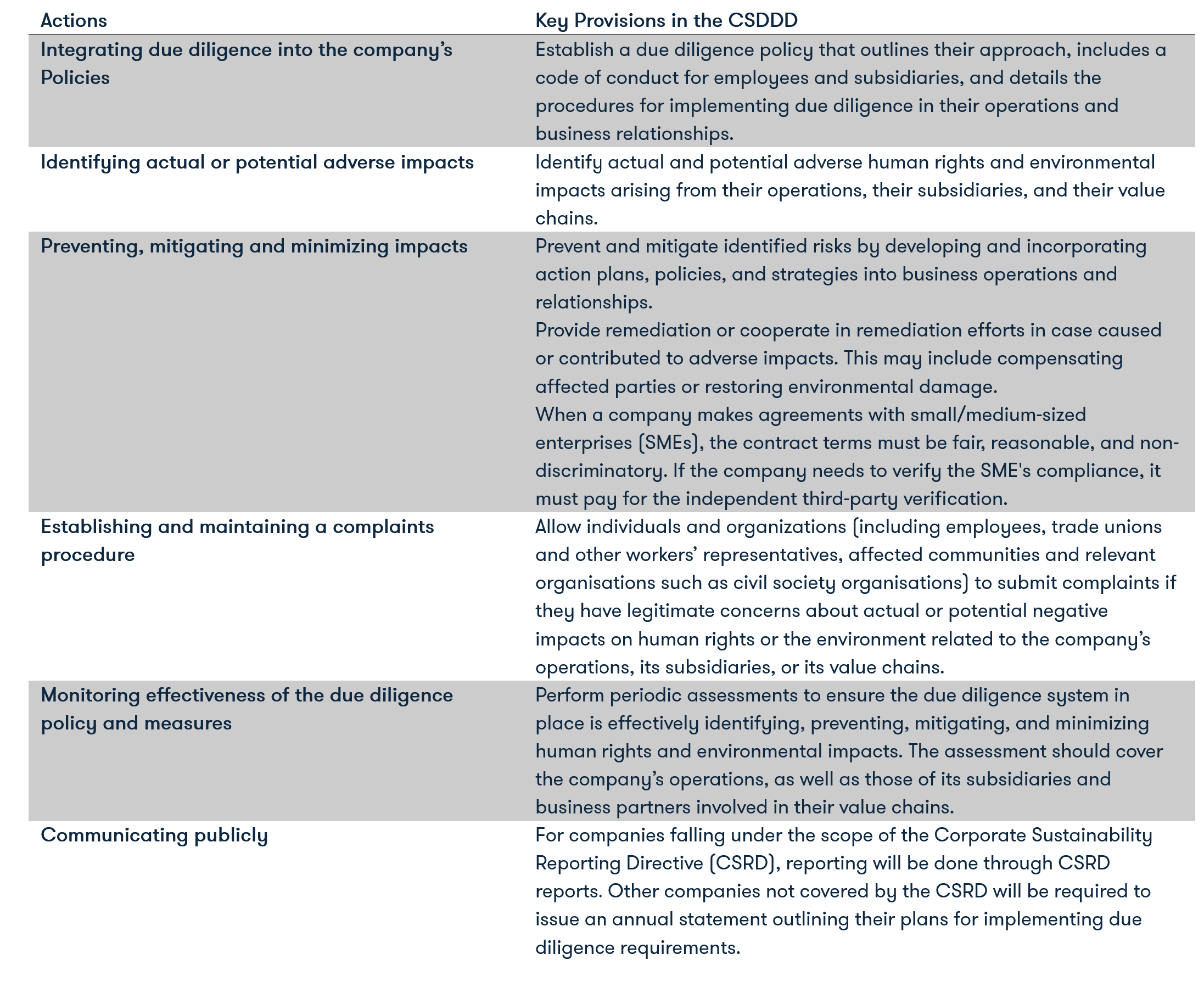

The CSDDD establishes minimum actions that companies should take when conducting human rights and environmental due diligence. The details of these actions are summarised in the table below:

Implementation Timeline

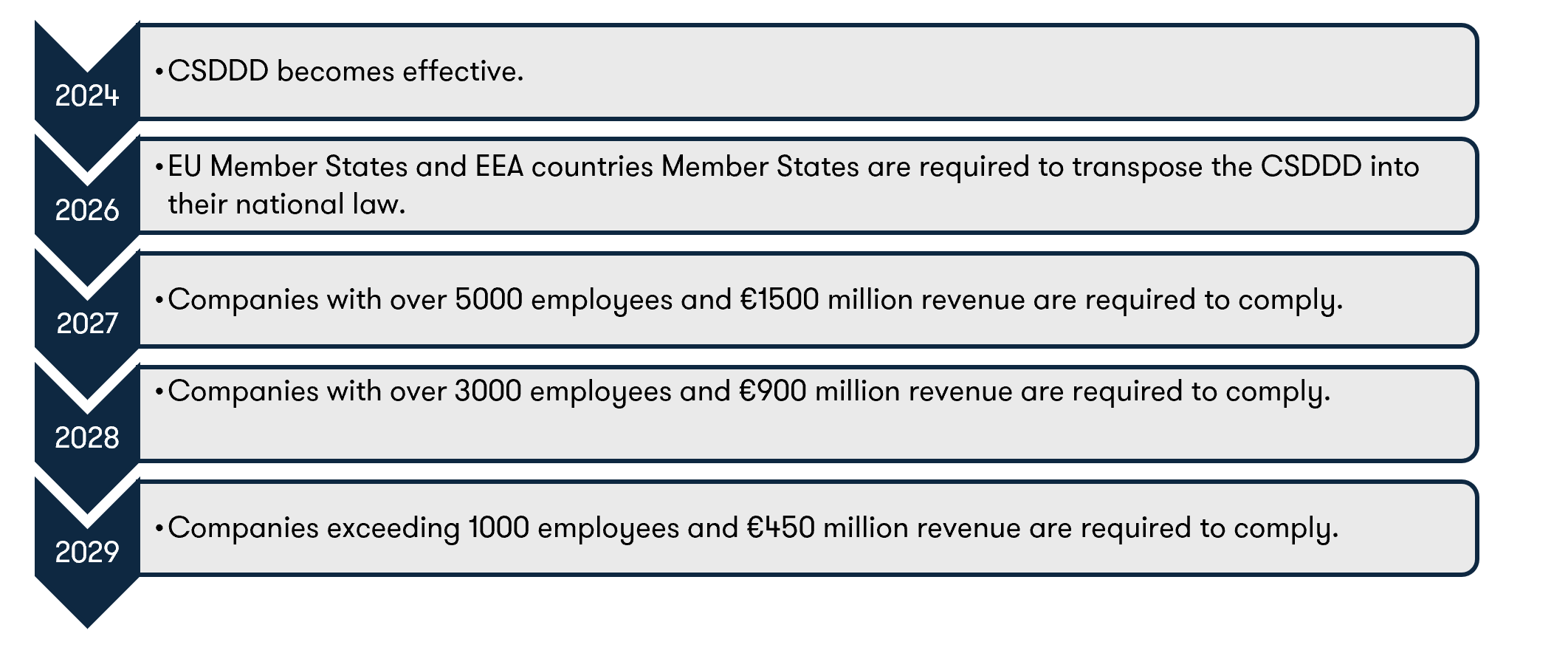

The CSDDD will take effect 20 days after its publication in the Official Journal of the European Union. Following this, it will be implemented in stages as shown in the figure below, beginning with a two-year period during which Member States will incorporate the CSDDD into their national laws.

Civil Liability

As per the civil liability article, companies subject to the CSDDD will be liable to full compensation when they, their subsidiaries, or direct business partners neglect their due diligence obligations, resulting in intentional or negligent actions that cause harm to individuals or the environment.

Implications for Businesses

The CSDDD marks a notable change in regulatory norms, urging businesses to embrace sustainable and ethical approaches. Affected companies will be required to enhance their due diligence mechanisms significantly and embed sustainability within their fundamental operations. The CSDDD also encourages innovation, as businesses seek to develop new solutions to minimize their environmental footprint and enhance their social impact. Through our many years of experience of advising investors and lenders on these issues, Infrata is ideally placed to support companies on their journey towards compliance with the CSDDD.