Road Traffic in the Covid-19 Pandemic – Evidence for Recovery?

Posted 23/10/2020 by Connor Doolittle

2020 has been marked by the restriction of movement across the globe, as nearly every country has put into force measures aimed at slowing the spread of the Covid-19 virus. Movement of people has not only been dampened internationally but domestically as well.

Local movements have been affected by two primary sources: restrictions on travel within internal country borders and the shift to working from home, the latter more prominent in the more developed economies of Western Europe and North America. Consequently, road traffic patterns have undertaken a fundamental shift with volumes reducing to levels unseen in recent history.

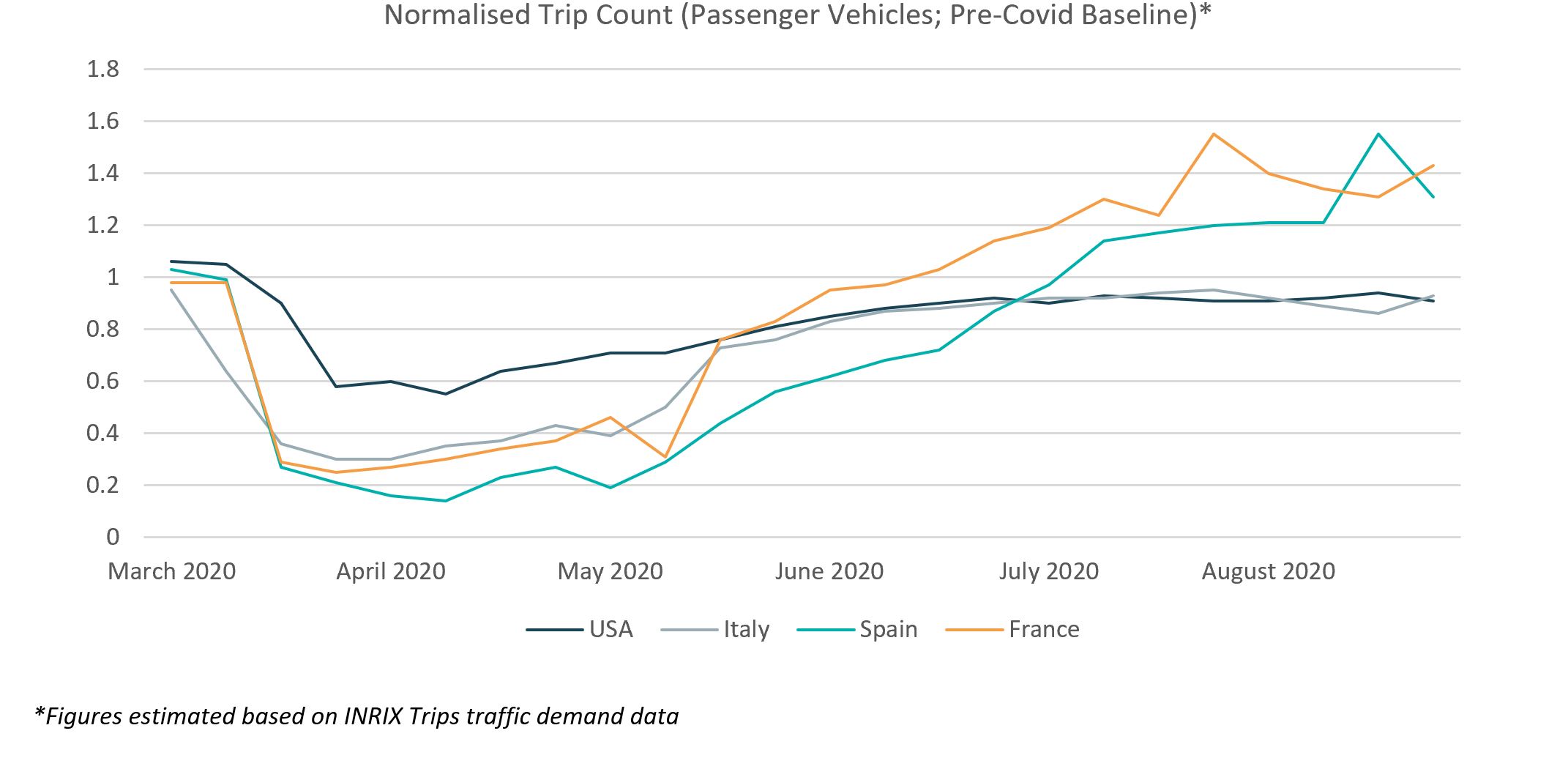

This phenomenon can be seen in the following charts which display the normalized number of passenger road trips taken versus confirmed Covid-19 cases between March and August 2020 for four selected countries: the USA, Italy, Spain, and France.

When observing overall trends in passenger vehicle trips, it is evident from the figures above that each of the selected countries has experienced a significant return of passenger trips from the doldrum seen during the pandemic height in April 2020, albeit at different times and to different degrees. This is reasonable to expect, as restrictions on the movement of people have been gradually lifted throughout the past several months. Additionally, an important new factor has come into play for road traffic. Since the outbreak of Covid-19, travel in personally owned, private vehicles have been deemed safer than public forms of transport. As such, people have been and will continue to take more of their trips using cars.

As of August 2020, both the USA and Italy have yet to reach the same level of passenger trips as the pre-Covid baseline. On the other hand, Spain and France have exceeded baseline levels for passenger trips, despite strict lockdown measures and a rapid acceleration of virus transmission beginning in August. Even in the USA and Italy, where the virus continues to circulate, it appears that passenger traffic has reached a stable level and has not significantly declined. There is potential for traffic to be decoupling in part from the virus as people adjust to living with increases in circulation. However, it must be kept in mind that politicians continue to be willing to maintain and dole out new restrictions on movement and the novelty of the virus continues to affect people’s attitudes towards travel.

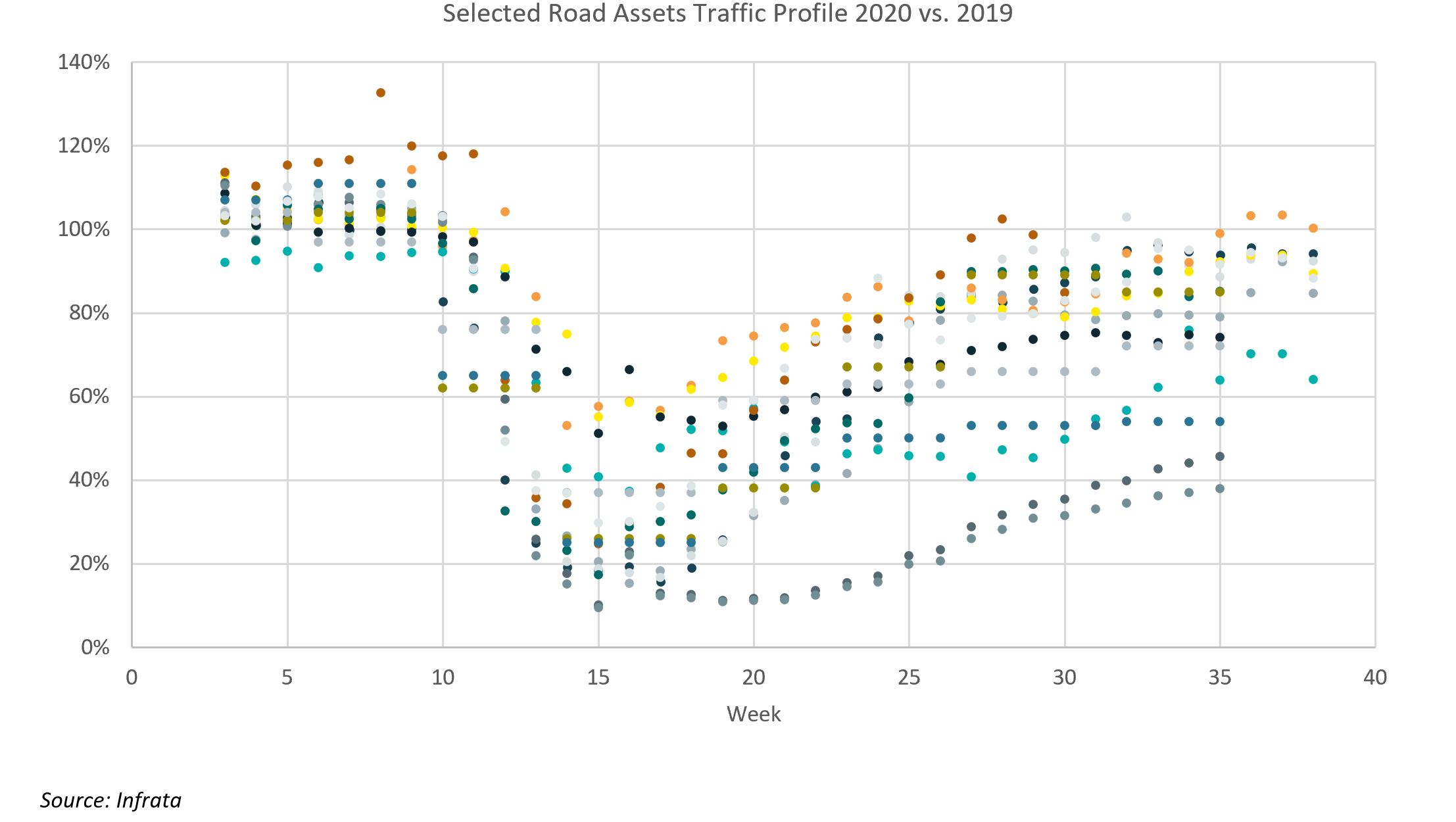

A similar exercise can also be performed on individual road segments and assets, as in the case of the road assets displayed in the chart above. The selected assets cover a range of roads in Europe and Latin America. It is notable that the roads displayed have largely experienced a marked traffic recovery from the height of the pandemic in Weeks 15 – 20. By Week 35, most roads in the sample had recovered to 60 – 80% of 2019 levels. The recovery appears to be largely a check-mark shape, with several roads experiencing a more protracted U-shaped recovery. As mentioned previously, each country has implemented different restrictions at different times on the movement of people aimed at curbing the spread of Covid-19.

It is evident that the recovery of traffic on each road will be influenced not only by the national restrictions imposed but also by the particular geographic and operational characteristics of the road as well as the traffic base on which it relies. For instance, a tolled managed lane asset, which acts as a tolled alternative to a free competing road, would be expected to experience a more protracted recovery in the presence of lower than average traffic levels on the free alternative, especially during peak commuting periods as working from home has become more prevalent.

It is important to have a solid appreciation of these factors when attempting to forecast road traffic in the wake of unprecedented restrictions on movement. Because of the unique nature of the Covid-19 pandemic, benchmarking against other countries has become an even more powerful tool. The traffic trends experienced by another country under similar restrictions or at the time of similar virus circulation can point in the right direction for traffic expectations. Although a notable amount of recovery has been observed at a high level, it is not yet evident whether these traffic figures are sustainable with continued convergence towards pre-Covid trends. It is not clear yet whether the virus may trigger a systemic shift in people’s behavior and their travelling requirements and if this is offset by the bias towards private vs public means of transport.

Infrata uses a scenarios approach to present different assumptions surrounding the impact of the pandemic on traffic in 2020, the pace of recovery from 2021, and various unique factors that define each road asset.