This is an opportunity to set our sights on climate change. The investment world must take it.

Posted 31/03/2020 by Cristian Porras

Strange, how one challenge can help shine light on another. This is precisely what we’re seeing thanks to COVID-19. As social distancing measures slow business, industry, and tourism around the world, one of the broader, less negative side-effects of the virus is slowly becoming apparent: a sizeable drop in carbon emissions.

This serves as a reminder of our longer-term challenges, and to the possibility of change. While the current pandemic is rightly dominating the headlines of the day, the world of investment must not lose sight of the threat posed by climate change. This is an opportunity to do the right thing. And we must take it.

Sustainability Comes to the Fore

The importance of environmental concerns to investment is not lost on Larry Fink, President of Blackrock – the world’s biggest asset management firm. Fink cites climate change as the main concern of the company’s investors. Along with other leading investment companies, Blackrock is now incorporating sustainability into the core of its decision making. This sits alongside an increased focus on Environmental, Social, and Governance criteria (ESG).

Of course, climate change isn’t just having an impact on the environment. In turn, it’s affecting global economies. Investments in infrastructure, agriculture, irrigation, and potable water supplies are all impacted directly by changing weather patterns. Accordingly, investors are demanding increasingly stringent risk assessment in this area. Factors such as fluctuating precipitation and its projected impact on investment feasibility are now high on the agenda.

The Rise of Green Bonds

The financial sector is also showing a growing interest in environmental matters. In addition to the growth of responsible investing, various financial instruments have been introduced – Green Bonds being the most notable.

Green Bonds are debt securities issued to raise capital for the backing of projects related to the environment or climate change. In order to qualify, the bonds must be certified – a process requiring strict transparency reports for the bond holders.

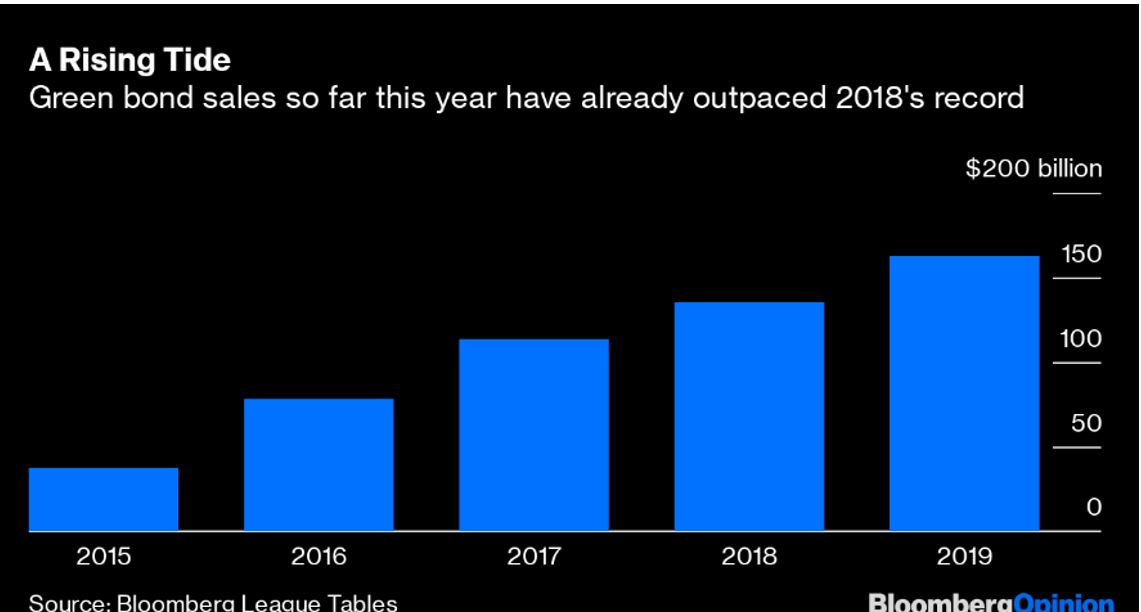

This class of investment has performed well since its first issuance in 2008, doubling the figures reported in 2016. The bonds have shown a steady growth tendency, highlighting the remarkable appetite that exists in the market for such eco-friendly investments.

Making a Difference

The financial sector’s increased interest in environmental matters has had majorly positive implications well beyond the financial realm. Data published by the World Bank in 2018 shows the aforementioned financial instruments to have had a colossal environmental impact.

To put some numbers to that success: An estimated 50,000 tons of CO2 have been avoided by clean energy and transportation projects as a result of these measures. Enhanced forest conservation contributed an astonishing 6 million tons of avoided carbon emissions.

Specialised funds are also playing a role – notably, the Green Climate Fund, which was established following the United Nations climate change convention framework of 2010. This fund reported a staggering 1.6 trillion ton CO2 saving, through the financing of some 129 projects. The numbers are impressive.

We Must Go Further

The track record of the investment market is undoubtedly positive when it comes to climate change. But the environmental impact of COVID-19 shows us that there’s far more we can be doing. After all, this pandemic will pass. Transportation and industrial processes will restart. And so too will their carbon footprints.

Those of us in the world of investment must use this opportunity to look at what can be done to mitigate the longer-term implications of climate change. As a 2019 World Meteorological Organisation (WMO) report states – the conditions surrounding climate change could not be more serious. In their words, “it is more urgent than ever to proceed with mitigation actions”. And we must all do our bit.