ESG and the Equator Principles: Time to Take Stock

Posted 11/03/2021 by Ray Powell

Back in 2003, the World Bank launched a new risk management framework called the Equator Principles. The Principles comprised a set of voluntary guidelines, to be followed by financial institutions as a means of ensuring the natural and social responsibility of any large-scale development project.

A decade and a half since the framework was announced, it’s time to take stock. How has the world of infrastructure responded to the Principles, and what’s next?

Changing Landscapes

First, it’s clear that the Principles have made a significant impact. Today, most of the world’s leading financial institutions have signed up to the Equator Principles methodology, in a bid to comply with certain environmental and social standards. These standards build on the 2015 Paris Accord, the UN Guiding Principles on Human Rights, and the United Nations Sustainable Development Goals. But what does that mean on a practical level?

We are seeing an increased corporate and governmental focus on sustainable and ethical business practices, exemplified by the emergence of new Environmental, Social, and Governance (ESG) criteria to screen potential investments.

As part of that trend, in March 2021 the EU brought into use its Sustainable Finance Disclosure Regulation (SFDR) which places new rules on investors and financial advisers to become more transparent on providing sustainability-related information on environmental, social and employee matters, respect for human rights, anti‐corruption, and anti‐bribery matters.

| Under the SFDR, Sustainable investment are defined as “an investment in an economic activity that contributes to an environmental objective as measured by such indicators as: the use of energy, renewable energy, raw materials, water and land, on the production of waste, and greenhouse gas emissions, or on its impact on biodiversity and the circular economy, or an investment in an economic activity that contributes to a social objective, in particular an investment that contributes to tackling inequality or that fosters social cohesion, social integration and labour relations, or an investment in human capital or economically or socially disadvantaged communities” |

ESG’s Winners and Losers

The results of these new ESG criteria are now becoming clear. It’s no surprise that sectors such as fossil fuel mining, nuclear power, and animal exploitation industries are feeling the backlash from socially-conscious investors. Meanwhile, ESG-compliant investments are providing higher rates of return, with lower risk.

Conducting its own research, Fitch found the energy sector to perform particularly poorly in ESG tests – due largely to its environmental impact. Conversely, renewables, transportation, and water projects had more favourable results. A report for Principles for Responsible Investment echoed this finding that carbon-intensive firms such as coal producers could lose 44% of their market value whilst companies in the same sector that transition to low-carbon technology such as renewables could grow 104%.

What next for The Equator Principles?

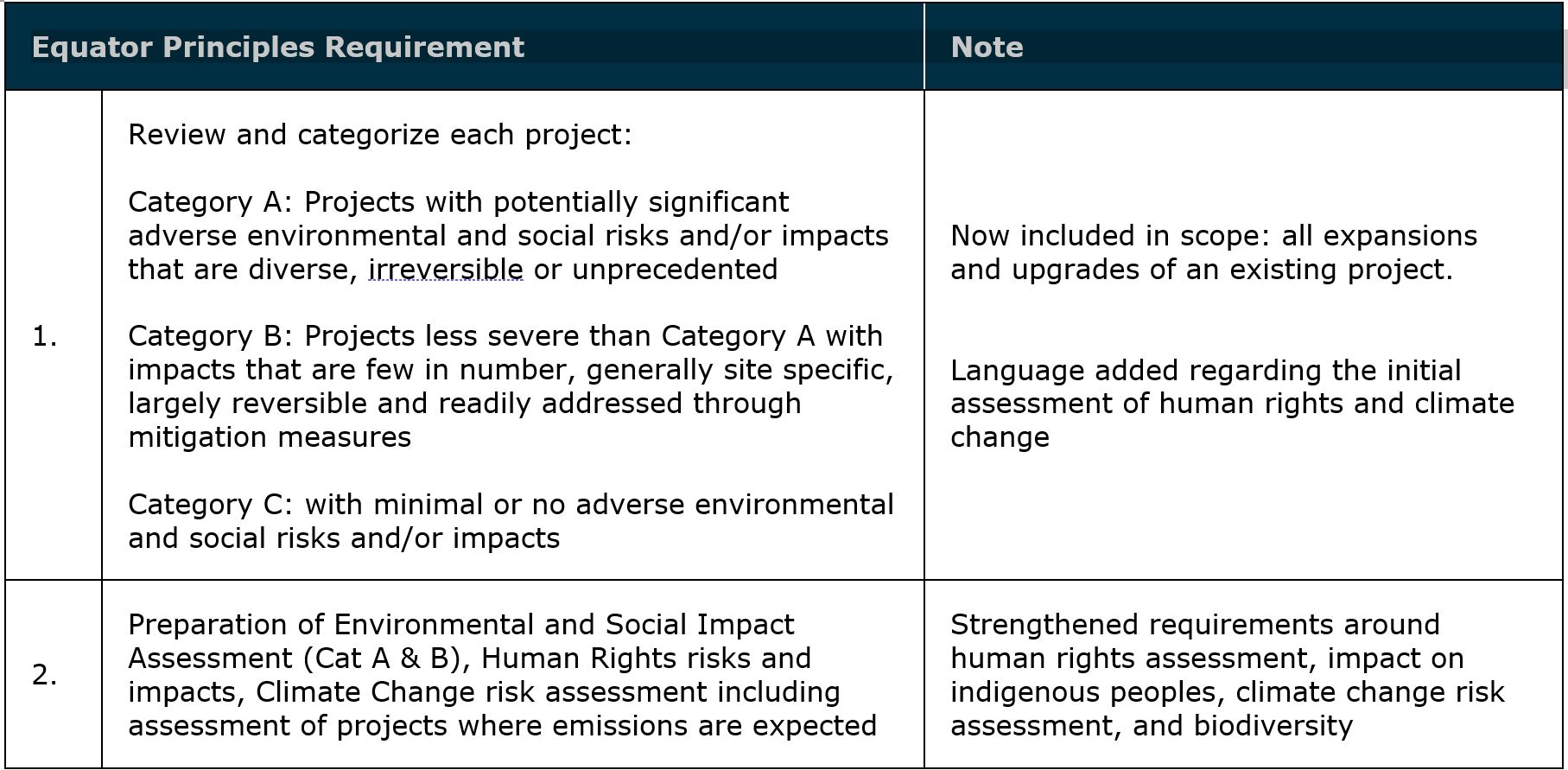

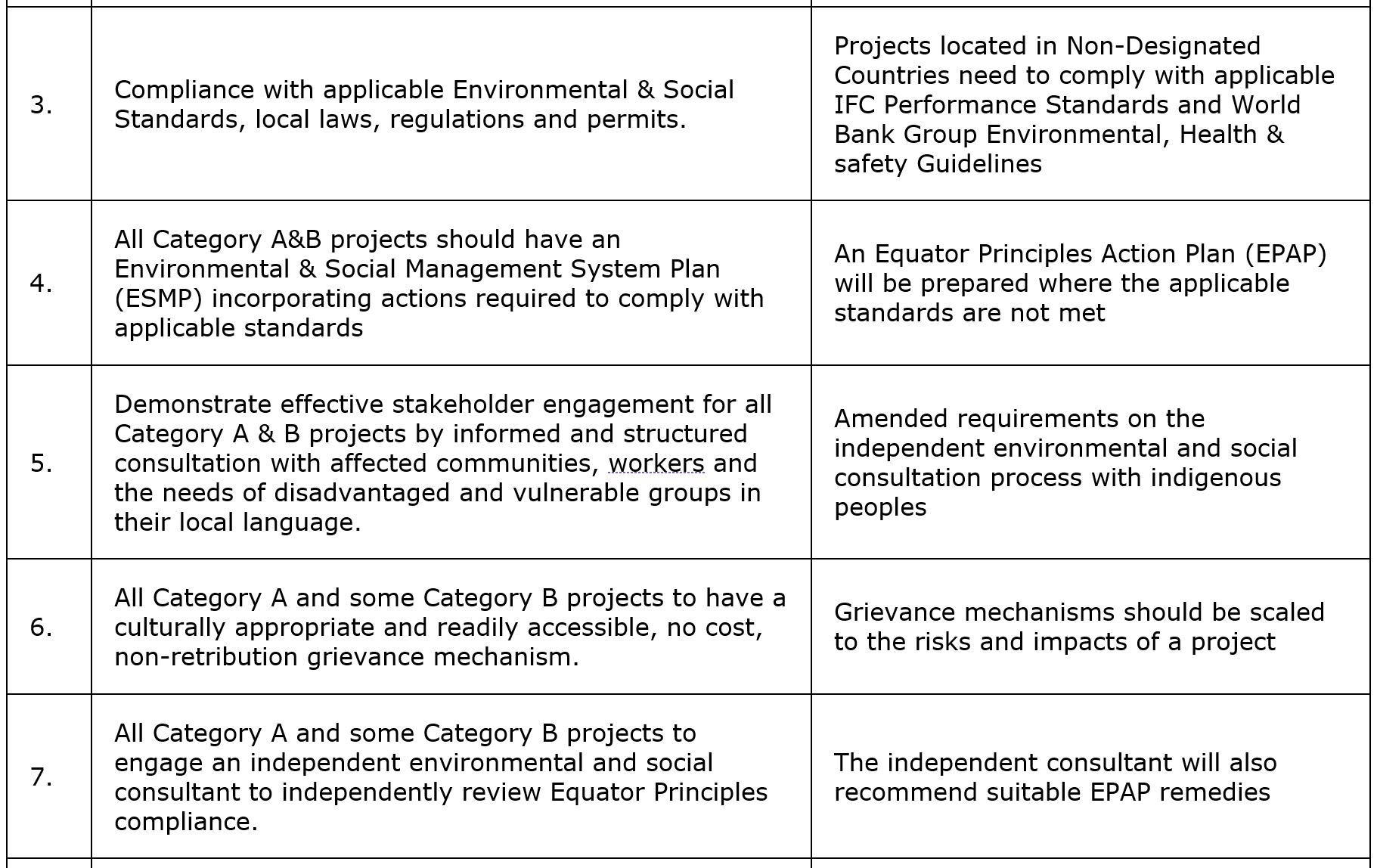

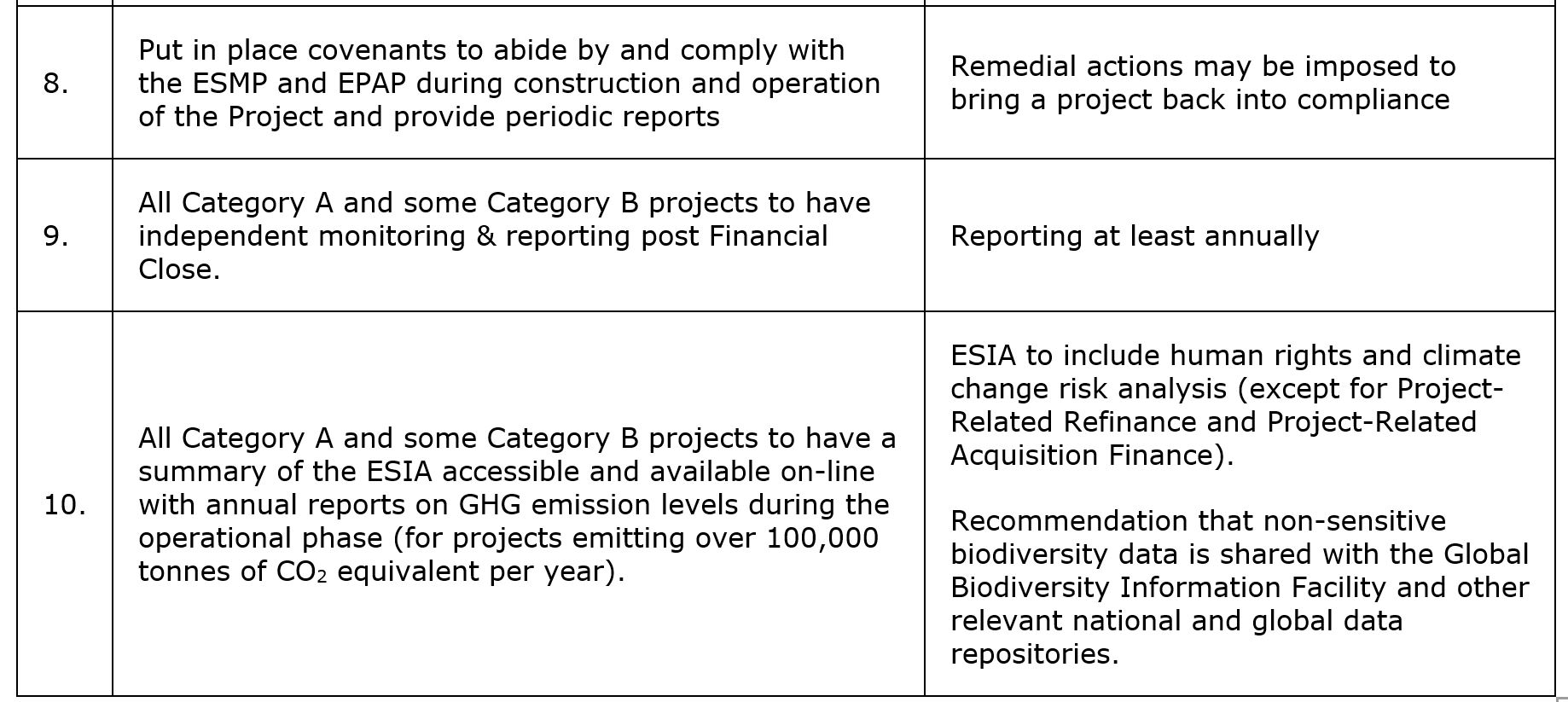

The Equator Principles Association recognised that its own criteria must change as the world changes around us. Only by readily adapting and modernising will the Principles maximise their impact. In November 2019, the Association released the fourth edition of the Equator Principles (EP4) which came into effect in October 2020.

One notable change in EP4 includes a more significant role for human rights. In practice, this requires greater and more meaningful consultation of indigenous peoples, where they are affected by proposed works. There are also changes to scope and applicability of the Principles, as well as updated advice relating to climate.

With increasing global awareness of climate on both political and social stages, it’s anticipated that the Equator Principles will continue to grow and adapt, in-line with evolving demands and more ambitious state targets.

Regardless of future developments, it remains essential for those in the business of infrastructure financing to maintain a clear knowledge and understanding of the Equator Principles, in their most up-to-date state.

To that end, a closer look at the key changes in EP4 is provided in the table below.