Aviation: Forecasting in the face of uncertainty and disruption

Posted 11/06/2020 by Dion Zumbrink

Scenario building as the preferred forecasting method

The Covid-19 Pandemic has shocked the world, leading to unprecedented governmental actions in an attempt to control the spread of the virus, including restrictive mobility measures. One of the sectors of the economy most impacted by these has been aviation, which has seen a dramatic reduction in activity up to 90-100% throughout April and May 2020, leaving airports with a fraction of their regular passenger traffic.

Of course, the key question is how demand will develop as we emerge from the pandemic. Since there are many factors impacting future traffic recovery, which are yet uncertain and impossible to forecast with any degree of accuracy, the industry’s approach to this has been based mostly on scenario building. It appears that all consultancies and forecasters have used a variation of this method. In part this is due to their lack of confidence in input parameters including political decisions and social events but also reputational risks of getting forecasts completely wrong if one subscribes to even a plausible and likely scenario at the time.

In our experience scenarios are particularly useful for developing strategies during extreme events considering the uncertainty of inputs. In McKinsey & Company’s words, scenarios uncover “inevitable or near-inevitable futures” and show “what the pre-determined outcomes will be of the recent or ongoing events”. Scenarios also protect against ‘groupthink’ which , looking back at governments’ responses to the pandemic, has been prevalent amongst decision makers.

As a result of this analysis we either run simulations to produce a likely outcome or a “natural” base case emerges in consultation with the client and their own view of risks. In each case this is a well-informed and considered assessment which answers most questions that lenders, investors or owners of airport assets might have.

Macroeconomic scenarios

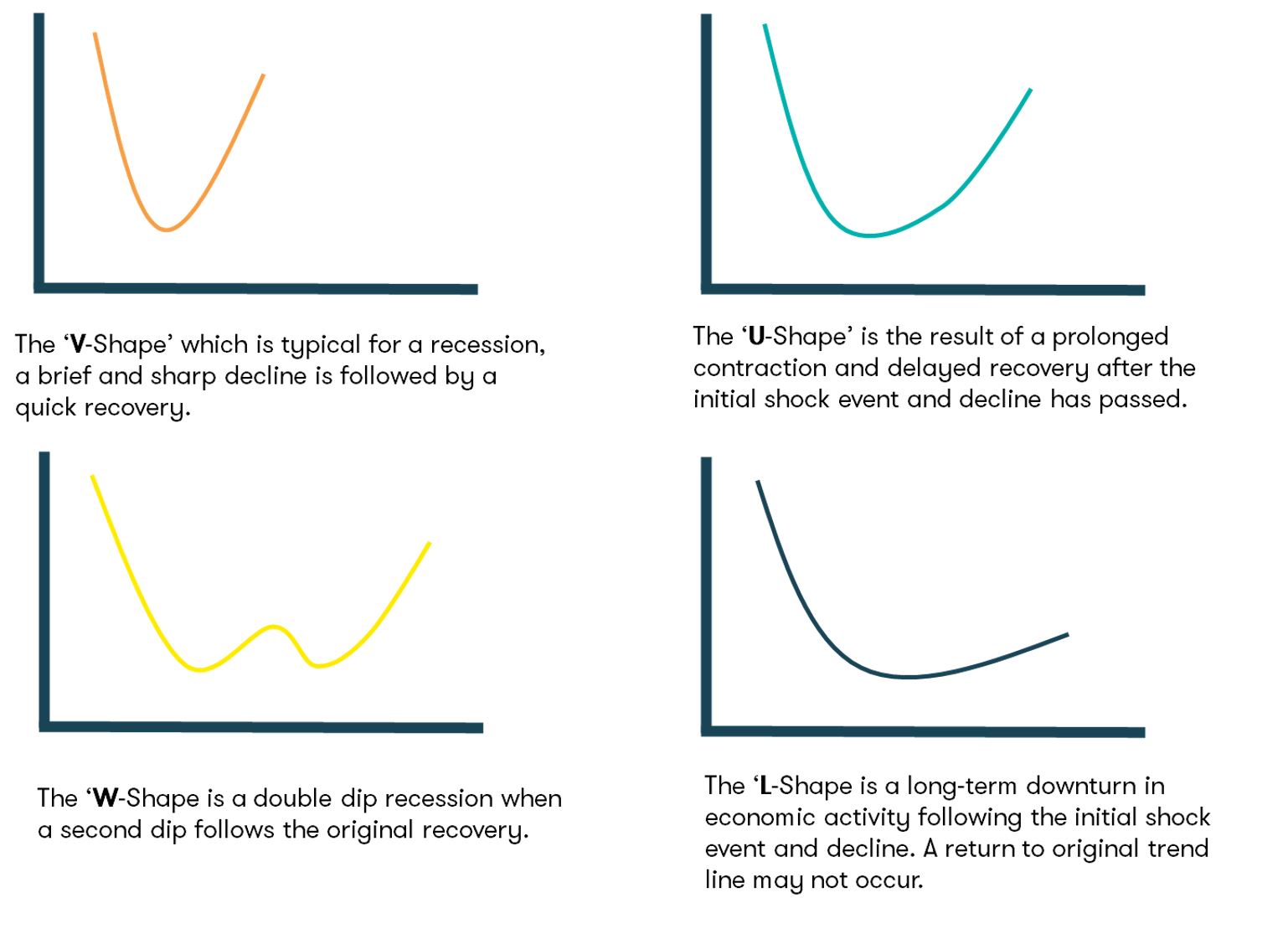

Underpinning and in some cases mirroring aviation industry forecasts are economic scenarios developed by banks and other organisations. Mostly, these follow four recovery patterns typically seen after a shock event. These have been popularized in the media recently and include:

For instance, ING (a Dutch-headquartered bank) has used scenarios to illustrate potential recovery paths for the global economy. Its Base Case assumes that European governments start relaxing the lockdown measures at the end of April and others follow in May. Global travel remains restrictive, but a second wave is avoided by preventative measures, leading to a ‘U-shaped’ recovery.

The ‘Winter Lockdown’ scenario varies from the base case in that a second wave of the virus occurs in autumn 2020 and leads to restrictions until April 2021. This results in a ‘W-shaped’ recovery.

The ‘Best Case’ scenario follows the recovery pattern within China, with a quick return to normality and following a ‘V-shaped’ path.

The ‘Worst Case’ scenario assumes that lockdown measures last until the end of 2020 and only when a vaccine is developed normality returns by Q2 2021. This scenario is the ‘L-shaped’ recovery.

Aviation Industry Scenarios

Various industry bodies and organisations such as rating agencies have prepared a range of recovery scenarios that are used as a reference point by consultants.

ICAO, for instance, has developed two scenarios for recovery of international and domestic traffic for each geographic region comprising three different recovery paths, with supply (seat capacity) and demand (load factors) as variables. Each scenario contains a different timing of the pandemic ending and the paths reflect different recovery rates.

The scenarios are all calculated as a percentage of the baseline traffic, which is defined as the original assumed traffic without the effect of the pandemic.

Three paths in each scenario present a base case with medium recovery after the pandemic peak is reached, an optimistic case which assumes there is pent-up demand and a very swift recovery after the pandemic peak, and a more pessimistic case which sees a prolonged recovery due to inter alia lack of passenger confidence, economic downturn or prolonged restrictive measures.

These scenarios cover such a wide range of options that the overall reduction in seat capacity varies between 33% to 60% in 2020, depending on the option.

Similarly, Fitch Ratings published a set of three scenarios for US airport traffic labelled as the Rating Case, the Sensitivity Case and the Severe Sensitivity Case. These scenarios vary, just like the ones by ICAO, in severity of the impact in 2020 and the recovery rate. The Rating Case and Sensitivity Case assume a recovery by 2022 to 2019 levels while in the Severe Sensitivity Case this is achieved by 2024.

Infrata’s experience and approach

Our forecasting work mostly focuses on specific airports or groups of airports. The technique we use is not dissimilar to that of ICAO, various financial institutions, and rating agencies. The key difference and our added value are in our analysis of micro-level of impacts unique to specific countries or airports.

In our recent assignments for a variety of airports some of the parameters to determine the path of recovery from the pandemic have included:

As a result of this analysis we either run simulations to produce a likely outcome or a “natural” base case emerges in consultation with the client and their own view of risks. In each case this is a well-informed and considered assessment which answers most questions that lenders, investors or owners of airport assets might have.

References: